The outlook of the PSQ ETF has been a focus of interest among investors. Looking at the recent returns can provide valuable clarity into its future prospects. However, it's crucial to furthermore the underlying risks before making any decision choices. A detailed performance analysis should include both the profitable aspects and the risks to gain a holistic view.

Factors such as market conditions, industry-specific performance , and the ETF's holdings can impact its overall performance.

Navigating the Inverse QQQ Strategy:

ProShares Short QQQ (PSQ) presents a compelling opportunity for investors aiming for to profit from potential declines in the Nasdaq-100 index. This exchange-traded fund (ETF) implements an inverse strategy, meaning that it aims to counteract the performance of the QQQ ETF. However,, PSQ is {not without risk|. It's essential to understand its characteristics and potential drawbacks before committing capital.

Those interested in PSQ should carefully evaluate their strategic objectives. A short-term approach can be favorable to investors with a high risk appetite, but it's essential to track the fund's regularly. {Furthermore, |Additionally|, investors should be aware of the potential for substantial declines if the Nasdaq-100 rallies.

- Consideryour risk appetite carefully before investing in PSQ.

- Don't put all your eggs in one basket to manage risk.

- Keep up-to-date on news and trends that could affect the performance of PSQ.

Decoding PSQ ETF Returns: Leveraged Shorting in Action

The ProShares UltraPro Short QQQ ETF (PSQ) offers a compelling way analyze the potential gains of leveraged shorting. This ETF seeks consistent returns that are three times the inverse of the Nasdaq-100 Index. While this amplified exposure can lead remarkable profits during market downturns, it also carries heightened risk. Understanding the factors driving PSQ's performance requires a deep dive into the mechanics of leveraged shorting and its influence with the underlying index.

A key aspect is the compounding effect inherent in daily rebalancing. This means that daily fluctuations in the Nasdaq-100 Index are exaggerated by three, impacting PSQ's gains both positively and negatively. ,Moreover, investors should be aware of potential deviations between the ETF's actual performance and its targeted 3x inverse exposure, particularly over longer investment horizons. This gap can arise from factors such as bid-ask spreads and trading costs.

Navigating the complexities of PSQ requires a prudent approach. It is essential for investors to conduct thorough research before investing, taking into account their risk tolerance, investment goals, and understanding of leveraged ETFs.

Harnessing from a Digital Bear Market?

The recent decline/dip/slump in tech stocks has sparked/ignited/fueled considerable interest/speculation/debate among investors. Could the PSQ ETF be a viable strategy/vehicle/option for capitalizing/benefitting/leveraging on this bear market/downturn/correction? The PSQ get more info ETF, which tracks/mirrors/follows the performance of short-sold/inverse/opposite tech stocks, offers a unique/unconventional/alternative approach to navigating volatile/turbulent/fluctuating market conditions. However/Nevertheless/Despite this, it's crucial for investors to carefully/thoroughly/meticulously consider/evaluate/analyze the risks/potential downsides/challenges associated with this investment/strategy/approach.

Leveraged Short ETFs: Grasping PSQ's Potential and Pitfalls

Leveraged short ETFs like PSQ offer investors the possibility to profit from drops in specific market indexes. By enhancing the returns of their underlying holdings, these ETFs furnish a potent tool for hedging. However, it's crucial to comprehend PSQ's inherent risks before diving into this unpredictable investment strategy.

- One key consideration is the accelerated nature of leveraged ETFs, which can magnify both profits and losses over time.

- PSQ's performance are also heavily influenced by daily rebalancing, possibly leading to deviations from the target index's trends in the long run.

- Investors should thoroughly analyze their risk tolerance and investment objectives before exploring leveraged short ETFs like PSQ.

Examining PSQ Performance: Can it Worth the Volatility?

Performance stocks often generate significant returns, but their inherent fluctuation can be a major concern for traders. Understanding the performance of PSQ, a popular ETF that tracks the US market's most volatile stocks, requires a careful examination of its potential benefits and challenges. While PSQ can may offer substantial profits for those comfortable to handle market swings, it's crucial to completely understand the risks involved before investing capital.

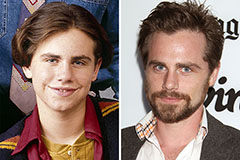

Rider Strong Then & Now!

Rider Strong Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Brandy Then & Now!

Brandy Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!